Cuyahoga County Property Taxes 2025. Rates are expressed in dollars and cents on each one thousand dollars of tax value. Cuyahoga county’s review of 522,000 properties will begin oct.

Cuyahoga county property taxes must be paid online, in person or postmarked by february 15, 2025. Cuyahoga county executive chris ronayne nominated nine women to advise the county on strategies to improve healthcare options for women.

Starting this month, cuyahoga county (the county) begins the daunting task of reappraising every property in the county for the sexennial reappraisal due to be.

Cuyahoga county, march 19, 2025 presidential primary all precincts, all districts, all counter groups, all scanstations, all contests, all boxes total ballots cast:

Property Tax Cuyahoga 2025, Property taxes must be paid. A mill is $35 in taxes for every $100,000 of taxable value, according to the ohio department of taxation.

Property Tax Cuyahoga 2025, Property taxes are due by february 15, 2025. Yearly median tax in cuyahoga county.

Property Tax Cuyahoga 2025, Cuyahoga county, march 19, 2025 presidential primary all precincts, all districts, all counter groups, all scanstations, all contests, all boxes total ballots cast: The deadline for residents to pay their property taxes in cuyahoga county without penalty has been extended from jan.

Median home values, tax rates for all Cuyahoga County villages, cities, Property taxes must be paid. Tax rates range from 1.6590% to 3.8446%.

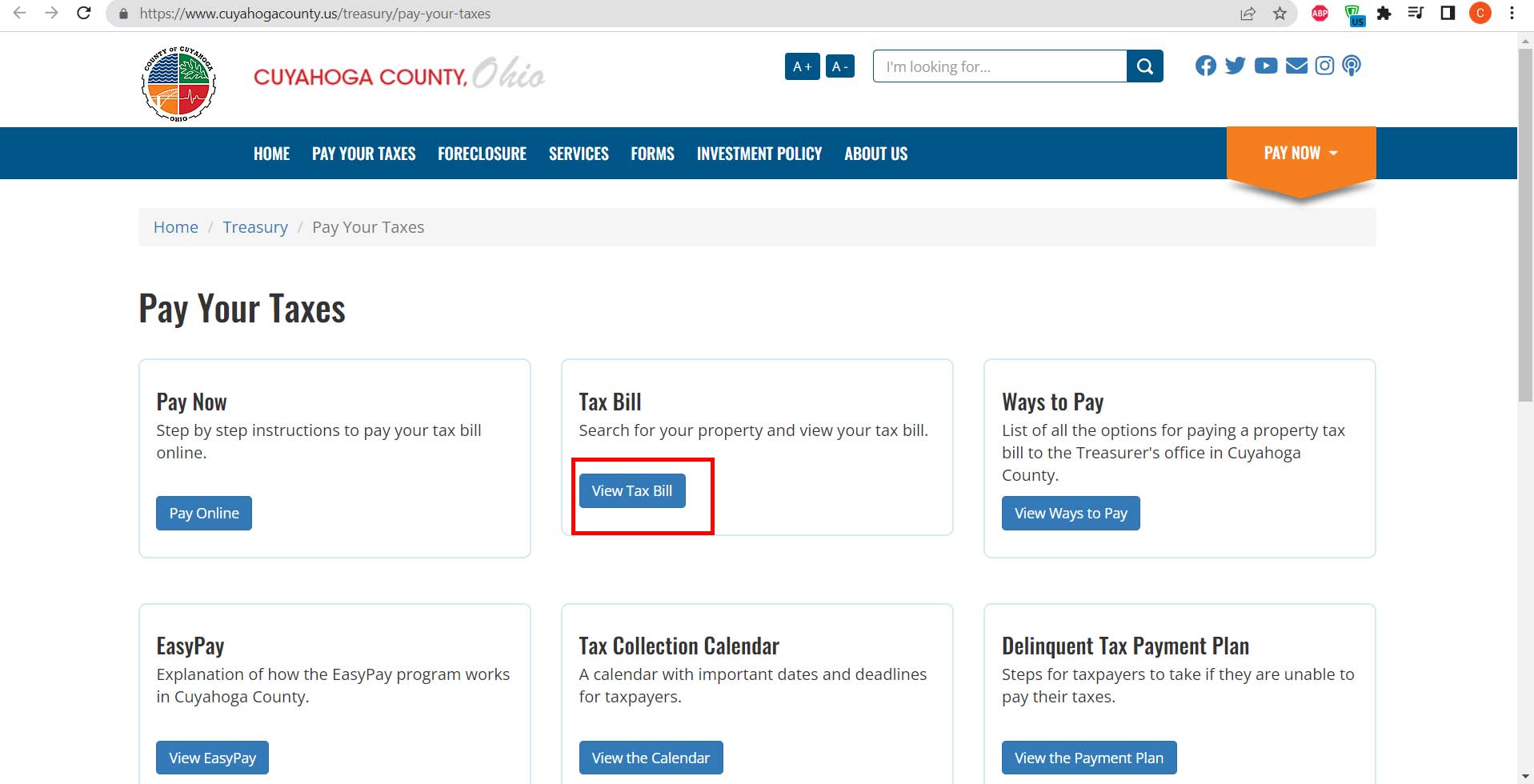

Compare property tax rates in Greater Cleveland and Akron; many of, Cuyahoga county treasurer’s office offers extended hours, multiple ways to pay property taxes. Tax bills are posted on the county website and via point & pay.

Property tax bite ranking Cuyahoga County towns for bills on typical, Cuyahoga county treasurer’s office offers extended hours, multiple ways to pay property taxes. How does your property tax bill compare?

Property Tax Cuyahoga 2025, See the new rates for every place in greater cleveland. Cuyahoga county, march 19, 2025 presidential primary all precincts, all districts, all counter groups, all scanstations, all contests, all boxes total ballots cast:

Cuyahoga County's already higher property tax rates grow the fastest, Though the levy is for 4.8 mills, the county only collects 3.7 mills, as it is an. Cuyahoga county’s review of 522,000 properties will begin oct.

Northeast Ohio property tax rates, typical and highest tax bills in, How does your property tax bill compare? 17, 2025 at 6:10 am pst.

These Cuyahoga County places have Ohio’s 6 highest property tax rates, Tax bills are posted on the county website and via point & pay. Property taxes must be paid.